Credit cards, debit cards, prepaid cards, virtual cards…thanks to technology, there is a growing variety of cards each with its own features. In addition to cash withdrawals or the purchase of goods and services in stores and other establishments, cards allow you to pay with your cell phone, receive alerts for each movement made or shop online in a more secure way. Alcune sono collegate ad un conto corrente, altre invece funzionano come delle semplici carte ricaricabili in cui versare contanti tutte le volte che se ne ha bisogno.

The method of paying by card in stores and online is increasingly widespread and used above all for safety and convenience. Anche se il funzionamento tra una carta di debito e una carta di credito può essere simile, ci sono delle differenze e hanno delle caratteristiche diverse che bisogna tenere in conto per gestirle correttamente e per sfruttare al massimo i vantaggi che ognuna offre.

To understand the difference, let's first start with the main features of each of these cards.

Pagamenti senza pensieri con le Carte BBVA

Caratteristiche della carta di debito

La carta di debito (chiamata comunemente anche bancomat) consente di spendere solo il saldo presente sul tuo conto corrente. It is the most used card due to its simplicity and convenience.

- It's linked to your checking account.

- When you make a withdrawal at an ATM (or cash machine) it is deducted from the balance you have available in your account at that moment.

- The debiting of a payment in a store or online is done automatically in real time.

- The balance limit depends on the total amount of money you have in your checking account.

- It allows for the withdrawal of cash at ATMs (cash machine) without fees. You pay only if the cash withdrawal takes place at a bank that does not have an agreement with your bank or when abroad.

- A PIN code is required to be able to withdraw cash or pay in stores.

- For online spending, the CVV code on the back of the card, the name of the cardholder and the PAN are required.

- You can also use it abroad because it is often associated with international circuits.

The debit card is secure and versatile, suitable for both online purchases and in-store purchases.

Caratteristiche della carta di credito

La carta di credito permette di fare acquisti anche quando non si dispone del denaro contante perché la spesa viene addebitata sul conto solitamente il mese successivo al pagamento effettuato.

- You can make payments in stores and online with money that your bank lends you and that you have to pay back within a certain period of time.

- It has a credit limit set by the bank and determined on the basis of your income.

- It allows you to finance purchases you wouldn't otherwise be able to make with your income or savings.

- It allows you to withdraw cash from ATMs (cash machines) by paying a fee.

- It can be used and is often required as a guarantee for hotel reservations, travel, car rental, etc.

Payment by credit card offers the great advantage of always having a credit limit that can be used for your purchases and expenses.

What's the difference between a credit card and a debit card?

Now that we have seen the main features and methods of use, let's go back to the initial question: What's the difference between a credit card and a debit card?

The difference between a debit card and a credit card is essentially related to how we pay the debt generated by our purchases. With a debit card, the payment is debited directly from the cardholder's checking account, thus allowing payment only if you have cash and up to the limit of funds in the account.

With a credit card, on the other hand, you can pay even if you have no funds, and postpone the payment until the following month. In this way, the cardholder takes out a debt with the bank and it is for this reason that before granting a credit card, the bank will verify that the customer has an income to cover any expenses.

Payment is usually debited from your checking account by the 15th of the month following the transaction and can be checked on your bank statement each month. With online banking, you can actually check the situation of your account at any time and wherever you are, thus being able to view all credit card transactions. This will allow you to check how much you are spending on credit and not find any surprises when your checking account is charged.

Ultimately, although the credit card is more flexible and has higher ceilings, with a debit card it is not possible to make purchases that require a greater amount than that available on your checking account, thus ensuring greater security and control.

Is it better to have a debit card or a credit card then? The answer is: It depends. There is no best solution but the most suitable solution for each person who will choose according to their needs and the type of use they will have to make of it.

Flessibilità e cashback con le Carte BBVA

Le Carte di pagamento BBVA offrono soluzioni flessibili e vantaggiose per ogni esigenza.

Con la Carta di Debito, puoi acquistare utilizzando il saldo disponibile sul tuo conto, senza costi di emissione o gestione, e rateizzare gli acquisti in 3, 5 o 10 rate mensili grazie a Pay&Plan.

Inoltre, nei primi 6 mesi, ricevi un cashback del 3% su tutti gli acquisti.

La Carta di Credito, invece, garantisce massima flessibilità nei pagamenti: puoi saldare in un'unica soluzione o suddividere gli importi in rate mensili da 3 a 36 mesi, oltre a trasferire fondi dalla carta al tuo conto corrente.

È gratuita il primo anno e il canone continuerà ad essere gratuito anche successivamente se la utilizzi regolarmente. Approfitta, inoltre, del Gran Cashback 20% il primo mese: riceverai fino a 100€ di rimborso su tutti i tuoi acquisti, in automatico.

Approfitta ora della flessibilità e del cashback esclusivo delle Carte BBVA!

You might be interested

-

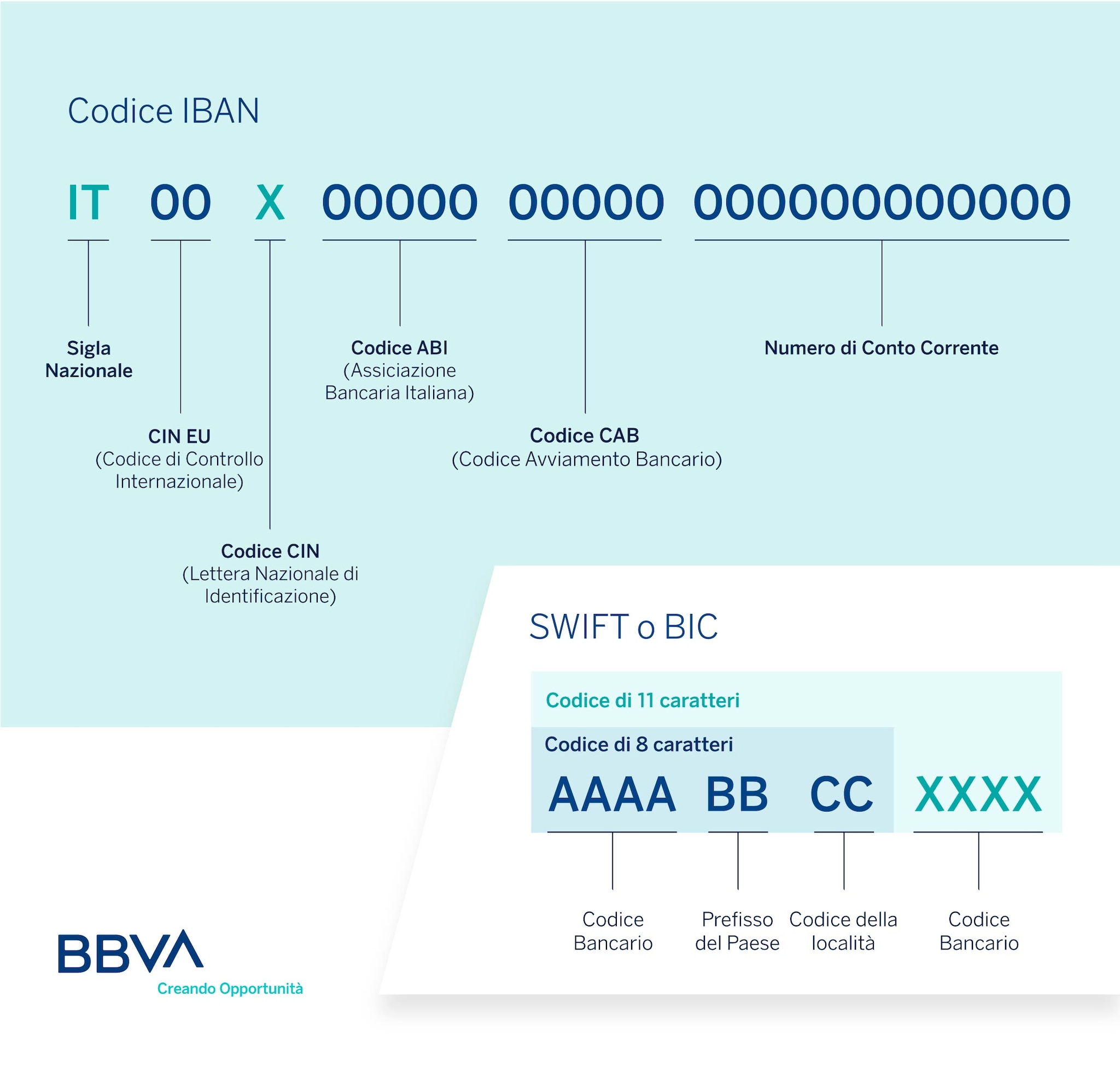

IBAN code and BIC or SWIFT code: what they are and what they are for

The IBAN code is the identification code of the current account number. The BIC or SWIFT code, on the other hand, is the one that corresponds to the banking institutions and branches. -

What is the business cycle and what are its phases?

The economic cycle is a set of economic phenomena that follow one another in a given period, divided into 4 phases based on the moment, ascending or descending, in which the market is found. -

Credit, debit and prepaid cards: features, operation and benefits

Features of credit, debit, and prepaid cards: find out how they work and choose the one that best suits your needs.